“How Can Online Insurance Quotes Help You Find the Best Home Coverage?”

In today’s fast-paced world, shopping for home insurance has become a lot more convenient. The rise of online platforms has revolutionized the way homeowners seek insurance, making the process more transparent, quick, and competitive. Gone are the days when you’d have to rely on an agent to provide you with home insurance quotes. Now, with just a few clicks, you can compare multiple policies, assess coverage options, and even make a purchase from the comfort of your home.

But, how do you navigate this vast sea of online insurance quotes? What factors should you consider, and what benefits and challenges lie in using online platforms to get your home insurance? This comprehensive guide will cover everything you need to know about online insurance quotes for home, helping you make an informed decision that protects your property and valuables.

Key Takeaways

- Convenience: Online quotes save time by providing immediate access to multiple offers.

- Cost-Effective: You can easily compare premiums and find discounts not available through traditional methods.

- Customization: Tailor coverage to your specific needs, ensuring adequate protection.

- Thorough Comparison: Ensure that you compare coverage, deductibles, and premiums before making a decision.

What is Home Insurance?

Home insurance is a policy designed to protect your home and its contents from financial loss due to various risks, such as fire, theft, vandalism, or natural disasters. It also typically provides liability protection in case someone is injured while on your property. Home insurance coverage can vary greatly depending on the insurer, the type of policy, and the level of coverage you choose.

Why Should You Shop for Home Insurance Online?

Shopping for home insurance online offers several key benefits, including convenience, transparency, and the ability to easily compare multiple policies. But why is it so important to shop online for quotes? Here’s why:

- Convenience: You can get quotes at any time, without the need to visit insurance agents or spend hours on the phone.

- Speed: Getting multiple quotes from different insurers only takes a few minutes.

- Transparency: Online platforms allow you to easily compare coverage options and premiums across multiple providers.

- Cost-Effectiveness: Online quotes often offer competitive pricing, and you may even discover discounts that aren’t available through traditional methods.

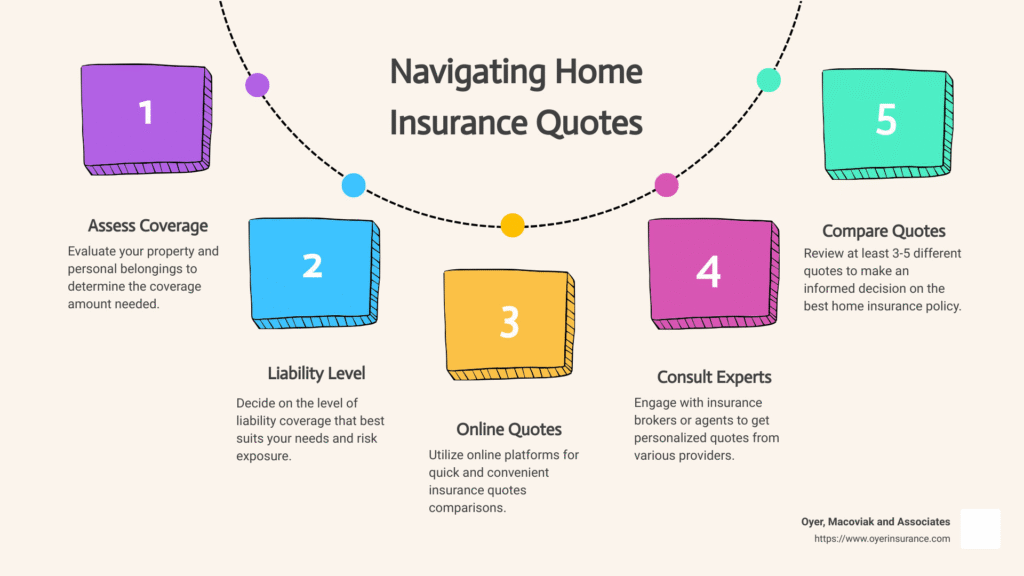

The Home Insurance Quote Process

The process of obtaining an online insurance quote for home coverage is simple and straightforward. Here’s what you need to know:

Step 1: Provide Your Property Details

To get an accurate quote, you need to input basic details about your home. This may include:

- Address of the property (which affects the risk level)

- Square footage of your home

- Year built and construction materials

- Home’s value (how much it would cost to rebuild)

- Presence of safety features (e.g., alarms, fire extinguishers)

Step 2: Select Your Coverage

The next step is to choose the type and amount of coverage you want. This might include:

- Dwelling coverage (for the structure of your home)

- Personal property coverage (for your belongings inside)

- Liability coverage (if someone is injured on your property)

Step 3: Review and Compare Quotes

Once you’ve entered your information, you’ll receive quotes from various insurers. It’s important to compare coverage options, pricing, deductibles, and additional perks.

Step 4: Finalize Your Decision

After comparing quotes, you can select the policy that best meets your needs and finalize your purchase directly online.

How Online Insurance Quotes Help You Find the Best Coverage

Convenience and Speed

One of the most significant advantages of using online insurance quotes is the speed at which you can gather and compare policies. In the past, homeowners had to meet with multiple insurance agents, fill out forms, and wait days for responses. Now, in just a few minutes, you can input your information and receive numerous quotes. This convenience allows you to make decisions quickly, without taking time away from your busy life.

Wide Range of Options

Online platforms provide access to numerous insurers, each offering a variety of coverage options. This means you are not limited to a single provider but have the ability to choose from a wide range of policies, each with varying terms and premiums. You can compare these options and find one that best suits your needs.

Cost Comparisons

One of the best ways to ensure you are getting the best value for your home insurance is to compare costs. Online platforms allow you to quickly compare premiums, which can vary dramatically from one insurer to the next. By understanding the costs involved and comparing them side by side, you can identify which policy provides the best value for the protection it offers.

Customization Options

Many online platforms allow you to customize your insurance coverage by adding additional features like flood insurance, earthquake coverage, or protection for valuable items. This flexibility ensures that your policy is tailored to your specific needs, helping you avoid overpaying for coverage you don’t need while ensuring you are adequately protected.

Factors That Influence Your Home Insurance Quote

Several factors play a crucial role in determining the cost of your home insurance, and understanding them is key to finding the best coverage. Here are the most common factors that influence your online home insurance quote:

Location

Where you live is one of the most significant factors affecting your home insurance rate. Homes in areas prone to natural disasters, such as floods, earthquakes, or hurricanes, tend to have higher premiums. Similarly, homes in areas with high crime rates or a history of frequent insurance claims may be more expensive to insure.

Home Value and Size

The value of your home, which includes its size, age, and condition, is another critical factor. The larger and more valuable your home is, the higher the potential cost to repair or rebuild it. Older homes, or homes with outdated electrical or plumbing systems, may also cost more to insure due to higher risk factors.

Type of Coverage

The type of coverage you choose, such as dwelling coverage, personal property coverage, and liability protection, will impact your quote. Comprehensive coverage options, which protect against a broader range of risks, tend to cost more than basic coverage.

Deductible Amount

A higher deductible can lower your premium but increases the amount you’ll need to pay out of pocket before your insurance kicks in. You should balance the deductible with your budget and risk tolerance to find the best combination of affordable premiums and manageable deductibles.

How to Compare Online Home Insurance Quotes Effectively

| Comparison Factor | What to Look For | Why It Matters |

|---|---|---|

| Coverage Limits | Review the amount of coverage for dwelling, personal property, liability, and additional living expenses. | Ensure that the coverage limits are adequate to fully protect your home, belongings, and liabilities. |

| Premiums | Compare the cost of premiums between different insurers and policies. | Find a balance between an affordable premium and comprehensive coverage without under-insuring your property. |

| Deductibles | Check the amount you would have to pay out of pocket before insurance kicks in. | A higher deductible can lower premiums but increases your out-of-pocket cost in the event of a claim. |

| Policy Exclusions | Review what is excluded from the coverage (e.g., floods, earthquakes, theft). | Understanding exclusions ensures you know what isn’t covered and can add optional coverage if necessary. |

| Additional Coverage Options | Look for additional coverage options, such as flood insurance, earthquake coverage, or high-value item protection. | Customize your policy to address unique risks like natural disasters or valuable personal property. |

| Customer Reviews & Satisfaction | Research customer feedback, ratings, and reviews of the insurer’s service and claims process. | Reliable customer service and efficient claims handling are important for peace of mind and claims success. |

| Claim Process & Payouts | Understand the insurer’s claims process and average payout time. | Choose a company with a streamlined, efficient claims process, as delays or complications can be stressful. |

| Policy Flexibility | See if the policy allows easy adjustments in coverage, deductible, or the addition of optional riders. | Flexibility allows you to adjust your coverage as your needs change over time without penalty or hassle. |

| Discounts | Look for any available discounts (e.g., bundling home and auto insurance, security systems). | Discounts can significantly reduce your premium costs, making your coverage more affordable. |

| Financial Strength of Insurer | Check the financial rating of the insurance company (using agencies like A.M. Best, Moody’s, etc.). | A strong financial rating ensures the insurer is financially stable and capable of paying claims. |

When you’re comparing home insurance quotes online, you must evaluate more than just the cost. Here are the key things to look for:

- Coverage Limits: Make sure the coverage limits are sufficient to protect your home and belongings.

- Exclusions: Check for any exclusions that could limit your protection.

- Customer Reviews: Review the insurer’s reputation for claims handling and customer service.

- Deductibles and Premiums: Compare deductibles, premiums, and the balance between them to ensure that the policy is both affordable and provides adequate protection.

- Additional Features: Look for special perks such as discounts, bundling options, and add-ons like identity theft protection or flood coverage.

Tips to Ensure You Get the Best Coverage for Your Needs

- Reassess Your Coverage Regularly: Your home’s value and your needs may change over time, so it’s essential to reassess your coverage every year.

- Bundle Policies: Many insurers offer discounts when you bundle home insurance with other policies, such as auto insurance.

- Consider Optional Coverage: If you live in an area prone to flooding, or if you have expensive personal items, consider adding specific coverage options.

Common Types of Home Insurance Coverage

Understanding the different types of home insurance coverage is key to choosing the right policy. Some of the most common types include:

- Dwelling Coverage: Protects the structure of your home from perils like fire, storms, and vandalism.

- Personal Property Coverage: Covers your belongings, including furniture, electronics, and clothing.

- Liability Coverage: Protects you if someone is injured while on your property.

- Additional Living Expenses (ALE): Covers living expenses if your home becomes uninhabitable due to a covered event.

Also Read: “What Are the Key Benefits of Personal Health Insurance?”

Conclusion

Online insurance quotes offer homeowners the ability to shop for home coverage with ease, speed, and flexibility. By understanding the quote process, comparing policies, and considering key factors like location, home value, and coverage needs, homeowners can find the best home insurance policy at an affordable price. Online platforms have transformed the way we purchase home insurance, making it easier than ever to secure the protection you need for your home.

FAQs

- How long does it take to get an online home insurance quote?

- Most quotes are available in minutes once you provide your information.

- Do I have to enter my personal details to get a quote?

- Yes, accurate personal details are necessary to provide an accurate quote.

- Can I get home insurance without a quote?

- No, quotes are necessary to understand the premium and coverage details.

- Can I adjust my coverage after getting a quote?

- Yes, you can adjust your coverage before finalizing the policy.

- Is online home insurance cheaper than going through an agent?

- Often, yes. Online platforms have lower operational costs, which can translate to lower premiums.

- Do I need to provide photos of my home to get a quote?

- Typically, photos are not required initially but may be requested later for verification.

- Can I cancel my policy if I find a better deal?

- Yes, most policies allow you to cancel within a grace period, though you may face cancellation fees.