Which Car Insurance Company Has the Best Claims Process?

When it comes to car insurance, your policy’s claims process can be one of the most important factors in determining your satisfaction as a customer. After all, the true test of your car insurance company’s service often comes after an accident or a loss. The ease, efficiency, and transparency of the claims process can make all the difference in how you perceive the quality of your insurer.

While many drivers may focus on factors like price, coverage options, and discounts when choosing a car insurance provider, it’s equally crucial to look into how each company handles claims. A smooth, quick, and hassle-free claims experience can help you get your life back to normal after an accident or an unfortunate event.

This article explores the best car insurance companies based on their claims processes, evaluates their performance, and highlights what makes each one stand out. By the end, you’ll have a clearer understanding of which insurer offers the best claims service for your needs.

Key Takeaways

- Claims Process is Key: The claims process should be a critical factor in choosing a car insurance provider, as it can significantly impact your experience during stressful times.

- Top Providers: Companies such as State Farm, Geico, and USAA offer excellent claims services, while others like Allstate and Progressive provide comprehensive options with room for improvement.

- Customer Reviews Matter: Always check customer reviews and ratings for a deeper understanding of how an insurer handles claims.

- Personalized Experience: Choose an insurer that provides a level of personalized support and flexibility that suits your needs.

What Is Car Insurance?

Car insurance is a contract between a vehicle owner and an insurance company. In exchange for a monthly or annual premium, the insurer provides financial protection against losses resulting from accidents, theft, or other unexpected events involving your vehicle.

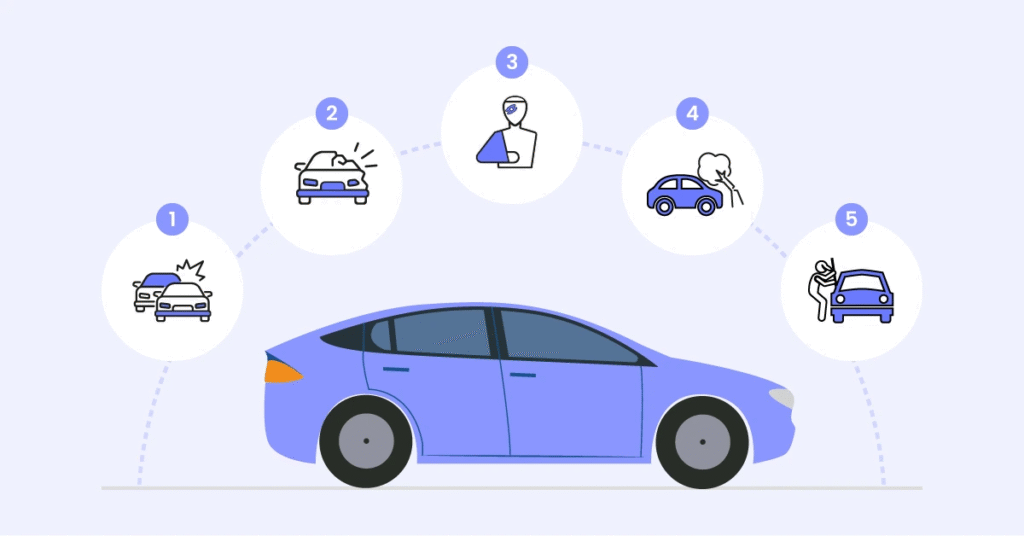

It helps cover:

- Damage to your car

- Damage you cause to others (liability)

- Medical bills

- Legal expenses

- Replacement if your car is stolen

Why Is Car Insurance Important?

- Legal Requirement: Most states in the U.S. require at least liability insurance.

- Financial Protection: Helps you avoid massive out-of-pocket costs.

- Peace of Mind: You’re covered when unexpected events happen.

Key Criteria for Evaluating Car Insurance Claims Processes

Before diving into the specifics of each company, it’s important to understand what makes a claims process “the best.” There are several factors that customers typically consider when evaluating claims services:

- Ease of Filing: How simple is the process of reporting a claim? Is it accessible via mobile apps, online portals, or through phone calls? A good claims process should be user-friendly and easily accessible.

- Speed of Resolution: How quickly does the insurance company assess, process, and resolve claims? Prompt resolution ensures that you aren’t stuck in limbo while waiting for your claim to be processed.

- Transparency: How transparent is the insurer about the status of your claim? Communication is vital during the claims process, and a company should keep you informed every step of the way.

- Customer Support: Does the company provide round-the-clock support? Having access to 24/7 customer service during a stressful time can alleviate anxiety and lead to faster resolutions.

- Claims Payment: Is the payment process fair, timely, and adequate? The company should promptly reimburse you for covered losses and repair costs.

- Customer Satisfaction: How satisfied are policyholders with the claims process? Online reviews, customer testimonials, and third-party ratings (like J.D. Power’s rankings) can give a good indication of a company’s reputation for handling claims.

Car Insurance – General Overview

| Category | Details |

|---|---|

| Definition | A contract between a vehicle owner and an insurance company that provides financial protection in case of an accident, theft, or damage. |

| Primary Coverage Types | – Liability: Covers damage/injury you cause to others – Collision: Covers damage to your own car – Comprehensive: Covers theft, weather damage, vandalism – Personal Injury Protection (PIP) – Uninsured/Underinsured Motorist |

| Mandatory in Most States | ✅ Liability insurance is legally required in most U.S. states |

| Optional Add-ons | – Roadside assistance – Rental reimbursement – Gap insurance – Custom equipment coverage |

| Premium Factors | – Age – Location – Driving history – Type of vehicle – Credit score – Coverage limits |

| Deductible | The amount you pay out-of-pocket before your insurance covers the rest of a claim |

| Claim Filing Methods | – Online – Mobile app – Phone – Through an agent |

| Top Providers (2025) | State Farm, Geico, Progressive, Allstate, USAA, Farmers, Nationwide |

| Tips for Saving | – Bundle with home insurance – Maintain a clean driving record – Increase your deductible – Shop around and compare quotes |

| Common Exclusions | – Intentional damage – Commercial use (unless specified) – Driving without a valid license |

| Who Needs It? | Anyone who owns or drives a vehicle – it’s legally required and financially protective |

State Farm – Known for Quick, Reliable Claims Process

State Farm is one of the largest car insurance providers in the United States, and it boasts a strong reputation for customer service and claims handling.

Pros:

- Mobile and Online Claims Filing: State Farm offers an intuitive app that allows policyholders to file claims directly from their smartphones. It also offers a simple online claims portal.

- 24/7 Support: With around-the-clock claims support, you can file a claim and get updates at any time of day.

- Quick Processing: State Farm is known for its efficiency in processing claims, with many policyholders reporting fast resolution times and minimal delays.

- Wide Network of Adjusters and Repair Shops: State Farm has a large network of appraisers and body shops, ensuring that repairs are handled quickly and effectively.

Cons:

- Variable Customer Service Experience: Some customers report inconsistent experiences with customer support, ranging from highly satisfied to frustrated with communication gaps.

Geico – A Strong Contender for Fast and Simple Claims

Geico is another top contender in the car insurance market and is well-regarded for offering competitive pricing and efficient claims processing.

Pros:

- Easy-to-Use Mobile App: Geico’s app makes it easy to file a claim, upload photos, track the status of claims, and even schedule an inspection.

- Rapid Claims Resolution: Geico is often praised for its swift claims handling, with many customers reporting quick payouts.

- 24/7 Customer Service: Geico’s customer service is available 24/7, allowing policyholders to get assistance whenever they need it.

Cons:

- Limited Availability of Local Agents: While Geico offers excellent online support, the lack of a nationwide network of physical agents may limit face-to-face assistance for some customers.

Progressive – Seamless Claims with Real-Time Updates

Progressive stands out for its comprehensive claims service, which includes a variety of communication channels and customer support options.

Pros:

- Claim Filing Flexibility: Progressive allows claims to be filed online, over the phone, or through its mobile app, giving policyholders multiple options.

- Real-Time Updates: One standout feature of Progressive’s claims process is the real-time status updates via their app, so customers can always know the progress of their claims.

- Dedicated Claims Representatives: Progressive assigns a dedicated claims adjuster to each case, providing a personalized experience.

Cons:

- Some Customers Report Delays: Although Progressive generally receives high marks for claims processing, some customers have noted delays in receiving payouts, especially for more complex claims.

Allstate – Strong Customer Service with a Personal Touch

Allstate is another prominent insurer with a reputation for strong customer service, including during the claims process.

Pros:

- Local Agents: Allstate’s network of local agents ensures that many customers have access to face-to-face support, which can be helpful during the claims process.

- Claim Filing Options: Allstate offers multiple ways to file a claim, including via their app, online portal, or over the phone.

- Quick Repairs: Allstate works with a network of repair shops and offers convenient rental car options for customers with damage claims.

Cons:

- Claims Can Be Complex: Some customers have reported that the claims process can be more complicated for extensive damages or certain types of claims.

USAA – Top Notch Claims Experience for Military Families

USAA, serving primarily military members and their families, offers one of the most customer-friendly claims processes in the industry.

Pros:

- Exceptional Customer Service: USAA ranks among the highest in customer satisfaction for claims processing, with many policyholders praising the professionalism and helpfulness of representatives.

- Fast Claims Resolution: USAA is known for its swift claims handling, often paying out claims faster than many of its competitors.

- Mobile App and Online Claims: Their mobile app allows for easy claims filing, tracking, and direct communication with adjusters.

Cons:

- Eligibility Restrictions: USAA is only available to military families, which limits its customer base.

Farmers Insurance – Comprehensive Support with Streamlined Process

Farmers Insurance offers a robust claims process with excellent customer service and a variety of communication channels.

Pros:

- Efficient Claims Process: Farmers is known for its fast claims processing and transparent communication, ensuring customers are always updated.

- Repair Network: Farmers has a vast network of approved repair shops, ensuring quality service when dealing with vehicle damage claims.

Cons:

- Customer Experience Varies: While many report positive experiences, some customers mention inconsistent service levels, depending on their region.

Nationwide – Solid Reputation for Claims Handling

Nationwide is another trusted name in car insurance, and their claims process has been praised for its efficiency and transparency.

Pros:

- Multiple Claims Channels: Nationwide offers several ways to file claims, including through their app, website, and by calling an agent.

- Personalized Service: Each claim is handled by a dedicated representative who can guide you through the process.

- Clear Communication: Customers frequently report that Nationwide provides clear and timely communication during the claims process.

Cons:

- Some Reports of Slow Payouts: A small percentage of customers report delays in receiving payouts, though these complaints are not widespread.

Also Read : What Is Business Insurance and How Does Liability Coverage Protect Your Company?

In the world of business,

Conclusion

When choosing the best car insurance company for your needs, it’s essential to consider not only the coverage and cost but also the claims process. A smooth, fast, and transparent claims process can make all the difference when you’re dealing with the stress of an accident or other unfortunate events. Companies like State Farm, Geico, Progressive, and USAA stand out for their efficient and customer-friendly claims services.

FAQs

Fastest Way to File a Claim:

- Mobile App or Online Portal: Most insurance companies offer apps or websites for submitting claims, which are usually the fastest methods. You can upload photos of the damage and fill out required information quickly.

- 24/7 Customer Support: Some insurers also offer immediate assistance via phone, so you can get guidance on how to file.

Timing for Filing a Claim:

- It’s best to report the accident right away to avoid any delays, even if your insurer allows a grace period of up to 30 days. Filing immediately helps prevent complications later in the process.

Choosing a Repair Shop:

- Insurance companies usually have a list of approved repair shops, but you’re generally free to choose your own. Just keep in mind that going outside the network might affect the claims process, and some shops might offer less favorable pricing or quality compared to the network.

Rental Car Coverage:

- Check your policy for rental coverage. Some policies include it, but it’s often optional. You might have to add it separately to your plan or get reimbursed if it’s not included upfront.

Processing Time:

- A simple claim may be resolved in a few days, but a more complex one, like involving serious damage or multiple parties, could take weeks. Keep in touch with your insurer for status updates and necessary paperwork.

If Your Claim Is Denied:

- Find out why your claim was denied. You can appeal the decision, and it might help to ask for a second review. Many states also offer mediation services to help resolve disputes with insurers.